Oil Prices Edge Lower Amid Economic Uncertainty and Trade Developments

News 09:07 AM - 2025-07-29 PUKMEDIA

PUKMEDIA

Oil field.

Oil prices dipped slightly on Tuesday as investors assessed the global economic outlook in light of the newly announced U.S.-EU trade agreement and awaited the U.S. Federal Reserve’s upcoming interest rate decision.

Reuters reported that Brent crude futures fell by 6 cents, or 0.1%, to $69.98 a barrel at 04:25 GMT, while U.S. West Texas Intermediate (WTI) crude dropped by 11 cents, or 0.2%, to $66.60 per barrel.

Both benchmarks had gained over 2% in the previous session, with Brent crude reaching its highest level since 18 July on Monday.

The recently concluded trade agreement between the United States and the European Union avoided a full-scale trade conflict, which had threatened to impact nearly a third of global trade and dampen fuel demand. The deal includes a 15% import tariff on most EU goods and stipulates $750 billion worth of EU purchases of U.S. energy over the coming years—a target analysts view as highly ambitious. Additionally, European firms are expected to invest $600 billion in the U.S. over the course of President Donald Trump’s second term.

Separately, senior economic officials from the U.S. and China convened in Stockholm on Monday for more than five hours of talks aimed at resolving long-standing trade and economic disputes between the world’s two largest economies. Negotiations are expected to continue on Tuesday.

Oil traders are also focused on the upcoming meeting of the U.S. Federal Open Market Committee (FOMC) scheduled for 29–30 July. While the Fed is widely anticipated to maintain current interest rates, market watchers are expecting a potentially dovish stance amid signs of moderating inflation, according to Priyanka Sachdeva, Senior Market Analyst at brokerage firm Phillip Nova.

In the energy sector, global green hydrogen developers are reportedly cancelling projects and scaling back investments, raising concerns that the world may remain dependent on fossil fuels longer than previously anticipated.

Meanwhile, President Trump on Monday issued a fresh deadline of "10 or 12 days" for Russia to demonstrate progress toward ending the war in Ukraine, or face new sanctions. The U.S. has also warned of sanctions against countries that continue to purchase Russian exports should no headway be made.

PUKMEDIA

More news

-

European Parliament Member Calls for Continued Humanitarian Aid to Rojava

01:55 PM - 2026-02-21 -

CDO, Sulaymaniyah University Delegation Conclude Field Visit to Historic Shu’aibiya Monument in Basra

11:53 AM - 2026-02-21 -

North Oil Company Says Kirkuk Gas Compression Station Fire Under Control

10:26 AM - 2026-02-21 -

U.S. President to Visit China Amid Supreme Court Tariff Ruling

09:31 AM - 2026-02-21

see more

P.U.K 01:32 PM - 2026-02-21 PUK President: We Promise to Work to Strengthen the Kurdish Language in Every Sphere

Deputy PM: Our Mission has Shifted from Preserving Kurdish Language to Developing It

11:28 AM - 2026-02-21

International Mother Language Day Highlights Urgent Need to Protect Linguistic Diversity

09:56 AM - 2026-02-21

Fahmi Burhan: District Status Change of Jalawla Is Unconstitutional

10:34 PM - 2026-02-20

PUK's Saadi Ahmed Pire Meets Swedish Left Party Delegation in Erbil

08:02 PM - 2026-02-20

Most read

-

The Battle for the Mind: Cultural Independence in a Changing Middle East

Opinions 12:10 PM - 2026-02-20 -

Kremlin Says Russia–Japan Relations “Reduced to Zero” Amid Territorial Dispute

World 02:05 PM - 2026-02-20 -

Only One Bakery Can Operate As Kobani Siege Continues

Kurdistan 05:05 PM - 2026-02-20 -

U.S. Pays $160 Million of More Than $4 Billion Owed to UN

World 11:03 AM - 2026-02-20 -

U.S. President Directs Government to Prepare Release of Aliens and UFOs Files

World 12:20 PM - 2026-02-20 -

PUK's Saadi Ahmed Pire Meets Swedish Left Party Delegation in Erbil

P.U.K 08:02 PM - 2026-02-20 -

Fahmi Burhan: District Status Change of Jalawla Is Unconstitutional

Kurdistan 10:34 PM - 2026-02-20 -

UK Foreign Secretary to Meet Rubio Amid Renewed U.S. Criticism Over Chagos Deal

World 05:42 PM - 2026-02-20

.jpg)

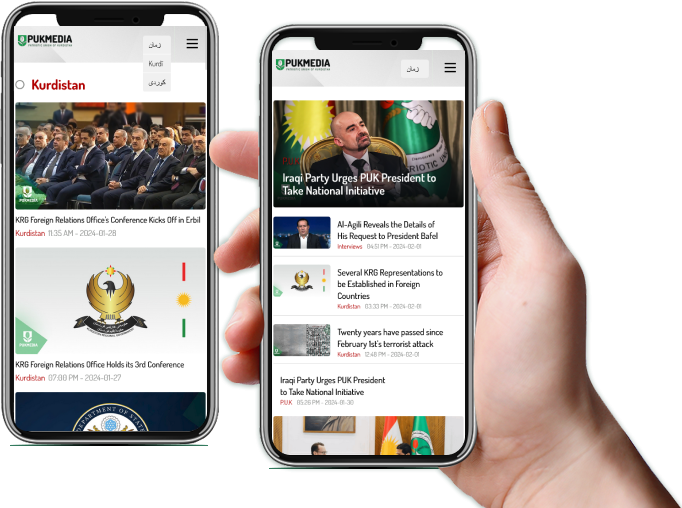

Application

Application