U.S. majors Exxon, Chevron post blowout earnings, ramp up buybacks

Economy 09:16 PM - 2022-07-29

Photo Credit: Reuters

The two largest U.S. oil companies, Exxon Mobil Corp (XOM.N) and Chevron Corp (CVX.N), posted record revenue on Friday, bolstered by surging crude oil and natural gas prices and following similar results for European majors a day earlier.

The U.S. pair, along with UK-based Shell (SHEL.L) and France's TotalEnergies (TTEF.PA), combined to earn nearly $51 billion in the most recent quarter, almost double what the group brought in for the year-ago period. All four have ramped up share buybacks in recent months, capitalizing on high margins derived from selling oil and gas.

Exxon outpaced its rivals with second-quarter net income of $17.9 billion, several billion dollars ahead of its previous record reached in 2012, which was aided by asset sales in Japan. The fifth major, BP Plc (BP.L), reports next week.

The companies posted strong results in their production units, helped by the surge in benchmark Brent crude oil futures , which averaged around $114 a barrel in the quarter.

High crude oil prices can cut into margins for integrated oil majors, as they also bear the cost of crude used for refined products. However, following Russia's invasion of Ukraine and numerous shutdowns of refineries worldwide in the wake of the coronavirus pandemic, refining margins exploded in the second quarter, outpacing the gains in crude, adding to earnings.

"The strong second-quarter results reflect a tight global market environment, where demand has recovered to near pre-pandemic levels and supply has attritted," said Exxon Chief Executive Darren Woods, in a call with analysts. "Growing supply will not happen overnight."

The results from the majors are sure to draw fire from politicians and consumer advocates who say the oil companies are capitalizing on a global supply shortage to fatten profits and gouge consumers. U.S. President Joe Biden last month said Exxon and others were making "more money than God" at a time when consumer fuel prices surged to records.

Earlier this month, Britain passed a 25% windfall tax on oil and gas producers in the North Sea. U.S. lawmakers have discussed a similar idea, though it faces long odds in Congress.

A windfall tax does not provide "incentive for increased production, which is really what the world needs today," said Exxon Chief Financial Officer Kathryn Mikells, in an interview with Reuters.

The companies say they are merely meeting consumer demand, and that prices are a function of global supply issues and lack of investment. The majors have been disciplined with their capital and are resisting ramping up capital expenditure due to pressure from investors who want better returns and resilience during a down cycle.

"In the short term (cash from oil) goes to the balance sheet. There's no nowhere else for it to go," Chevron CFO Pierre Breber told Reuters.

Worldwide oil output has been held back by a slow return of barrels to the market from the Organization of the Petroleum Exporting Countries and allies, including Russia, as well as labor and equipment shortages hampering a swifter increase in supply in places like the United States.

Exxon earlier this year more than doubled its projected buyback program to $30 billion through 2022 and 2023. Shell said it would buy back $6 billion in shares in the current quarter, while Chevron boosted its annual buyback plans to a range of $10 billion to $15 billion, up from $5 billion to $10 billion.

Exxon shares were up 3.2% to $95.60 in morning trading. Chevron shares rose 6.5% to $160.06.

PUKmedia / Reuters

More news

-

German Envoy Discusses Aleppo Situation with Mazloum Abdi

09:44 PM - 2026-01-09 -

France Condemns All Acts of Violence Targeting Civilians in Aleppo

07:36 PM - 2026-01-09 -

U.S. Envoy Says They Are Working to Extend Aleppo Ceasefire

10:11 AM - 2026-01-09 -

Oil Prices Rise for Second Day Amid Venezuela Uncertainty and Iran Unrest

09:45 AM - 2026-01-09

see more

World 05:51 PM - 2026-01-09 Two Hospital Workers Killed as Pro-Government Forces Attack Ashrafiyah in Aleppo

U.S. Envoy: Syria’s New Chapter is One of Cooperation, Not Confrontation

11:09 PM - 2026-01-08

SDF Commander Warns Attacks in Aleppo Undermine Negotiations and Endanger Civilians

10:15 PM - 2026-01-08

Italy Provide Medical Aid to Sulaymaniyah Health Directorate

03:16 PM - 2026-01-08

Israel Condemns Syrian Government 'Attacks Against Kurdish Minority' In Aleppo

11:20 AM - 2026-01-08

Most read

-

Syrian Kurds Must Not Be Abandoned in Their Struggle Against Jihadist Forces

Opinions 04:56 PM - 2026-01-09 -

U.S. Envoy: Syria’s New Chapter is One of Cooperation, Not Confrontation

World 11:09 PM - 2026-01-08 -

SDF Commander Warns Attacks in Aleppo Undermine Negotiations and Endanger Civilians

Kurdistan 10:15 PM - 2026-01-08 -

Supreme Alawite Council Condemns Repressive Practices in Aleppo

World 08:32 PM - 2026-01-08 -

Oil Prices Rise for Second Day Amid Venezuela Uncertainty and Iran Unrest

News 09:45 AM - 2026-01-09 -

U.S. Envoy Says They Are Working to Extend Aleppo Ceasefire

World 10:11 AM - 2026-01-09 -

Two Hospital Workers Killed as Pro-Government Forces Attack Ashrafiyah in Aleppo

World 05:51 PM - 2026-01-09 -

France Condemns All Acts of Violence Targeting Civilians in Aleppo

World 07:36 PM - 2026-01-09

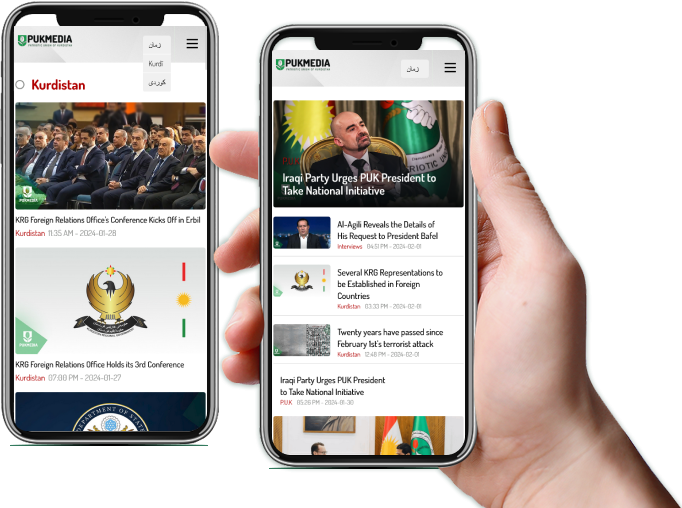

Application

Application