Gold and Silver Surge as Investors Seek Safe Havens

Economy 10:36 AM - 2026-01-29 Getty Images

Getty Images

Gold and silver.

Global precious metals markets have recorded sharp gains, with gold approaching $5,600 per ounce and silver climbing above $120 per ounce, as investors increasingly turn to safe-haven assets amid heightened economic and geopolitical uncertainty.

Gold has continued its strong upward momentum, driven by persistent demand from investors seeking protection against market volatility, currency weakness and geopolitical tensions. Analysts say the rally reflects growing concerns over global economic stability, prompting a flight to assets traditionally viewed as stores of value.

Silver has mirrored gold’s surge, breaking through key price levels and reaching its highest levels on record. In addition to its role as a safe-haven asset, silver has benefited from strong industrial demand, particularly in the renewable energy and technology sectors, tightening supply conditions and amplifying price pressures.

Market observers note that central bank gold purchases, sustained investment inflows and expectations of looser monetary policy in major economies have further supported precious metals. While some analysts warn that prices may face short-term corrections due to volatility, the broader trend remains firmly bullish.

As uncertainty continues to dominate global markets, gold and silver are expected to remain in focus, reinforcing their status as key assets for investors seeking stability in turbulent times.

PUKMEDIA

More news

-

Oil Rises as US-Israeli Conflict with Iran Expands

09:23 AM - 2026-03-03 -

European Gas Prices Jump 45% as Qatar Stops LNG Production

09:45 PM - 2026-03-02 -

Iraq's PM Orders Investigation into Assassination of Women's Rights Activist in Baghdad

09:38 PM - 2026-03-02 -

Mazloum Abdi Meets Joint Delegation from Qamishli and Damascus

07:42 PM - 2026-03-02

see more

U.S. President Says ‘Big Wave’ is Yet to Come in War with Iran

07:55 PM - 2026-03-02

'This is Not Iraq, This is Not Endless' Says U.S. Secretary on Iran

07:22 PM - 2026-03-02

Iraqi Prime Minister Directs Security Forces to Confront Any Threat to Iraq’s Stability

03:12 PM - 2026-03-02

US Warplanes Crash in Kuwait as Regional Tensions Escalate

11:22 AM - 2026-03-02

Most read

-

Oil Prices Surge as Strikes on Iran Rattle Global Energy Markets

News 09:52 AM - 2026-03-02 -

European Gas Prices Jump 45% as Qatar Stops LNG Production

Economy 09:45 PM - 2026-03-02 -

US Warplanes Crash in Kuwait as Regional Tensions Escalate

World 11:22 AM - 2026-03-02 -

Lebanon Govt Bans Hezbollah's Military Activities As Israel Retaliates After Attacks

World 04:18 PM - 2026-03-02 -

Iraq's PM Orders Investigation into Assassination of Women's Rights Activist in Baghdad

Iraq 09:38 PM - 2026-03-02 -

'This is Not Iraq, This is Not Endless' Says U.S. Secretary on Iran

World 07:22 PM - 2026-03-02 -

Kremlin Says Continuing Talks With Ukraine is in Russia's Own Interests

World 03:01 PM - 2026-03-02 -

Iraqi Prime Minister Directs Security Forces to Confront Any Threat to Iraq’s Stability

Iraq 03:12 PM - 2026-03-02

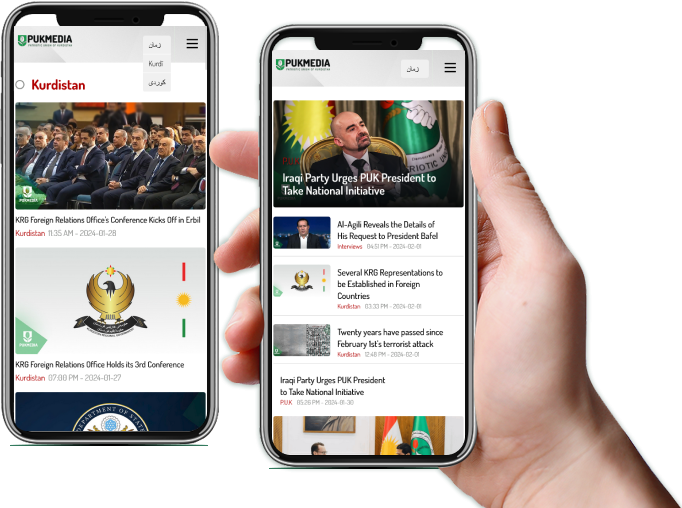

Application

Application