Global Gold Prices Surpass $3,600 Amid Geopolitical and Economic Uncertainty

Economy 11:13 AM - 2025-09-20.jpg) Freepik

Freepik

Gold.

Global gold prices have continued their relentless rise for the third consecutive year, surpassing $3,600 per ounce. Economic experts attribute the surge to a combination of central bank purchases, geopolitical crises, and shifting confidence in the U.S. dollar, signalling growing uncertainty in global markets.

Economics Expert Dr Lava Aras Ibrahim told PUKMEDIA that several key factors are driving the surge.

“One of the most significant factors is massive purchases by central banks. Since the outbreak of the war in Ukraine, they have acquired more than 115 million ounces of gold in an effort to reduce reliance on the U.S. dollar following Washington’s sanctions on Russia. For the first time in 29 years, the value of these banks’ gold reserves has exceeded their holdings of U.S. Treasury bonds, reflecting declining confidence in the dollar and the U.S. economy,” she explained.

Dr Aras added that geopolitical crises and global realignments are also contributing. “The emergence of new blocs, such as the BRICS alliance—which includes China, Russia, India, Brazil, and South Africa—has had a direct impact on reshaping global economic and political decisions.”

She further noted that expectations of a decline in the U.S. dollar and anticipated interest rate cuts by the Federal Reserve have bolstered demand for gold as a safe haven.

“Reports from international banks indicate that forecasts for gold prices are being revised upwards almost monthly. Should the Federal Reserve lose credibility under political pressure—particularly from former U.S. President Donald Trump—the price of an ounce could reach $5,000,” Dr Aras concluded.

PUKMEDIA

More news

-

Oil Rises as US-Israeli Conflict with Iran Expands

09:23 AM - 2026-03-03 -

European Gas Prices Jump 45% as Qatar Stops LNG Production

09:45 PM - 2026-03-02 -

Iraq's PM Orders Investigation into Assassination of Women's Rights Activist in Baghdad

09:38 PM - 2026-03-02 -

Mazloum Abdi Meets Joint Delegation from Qamishli and Damascus

07:42 PM - 2026-03-02

see more

U.S. President Says ‘Big Wave’ is Yet to Come in War with Iran

07:55 PM - 2026-03-02

'This is Not Iraq, This is Not Endless' Says U.S. Secretary on Iran

07:22 PM - 2026-03-02

Iraqi Prime Minister Directs Security Forces to Confront Any Threat to Iraq’s Stability

03:12 PM - 2026-03-02

US Warplanes Crash in Kuwait as Regional Tensions Escalate

11:22 AM - 2026-03-02

Most read

-

Oil Prices Surge as Strikes on Iran Rattle Global Energy Markets

News 09:52 AM - 2026-03-02 -

European Gas Prices Jump 45% as Qatar Stops LNG Production

Economy 09:45 PM - 2026-03-02 -

US Warplanes Crash in Kuwait as Regional Tensions Escalate

World 11:22 AM - 2026-03-02 -

Lebanon Govt Bans Hezbollah's Military Activities As Israel Retaliates After Attacks

World 04:18 PM - 2026-03-02 -

Iraq's PM Orders Investigation into Assassination of Women's Rights Activist in Baghdad

Iraq 09:38 PM - 2026-03-02 -

'This is Not Iraq, This is Not Endless' Says U.S. Secretary on Iran

World 07:22 PM - 2026-03-02 -

Kremlin Says Continuing Talks With Ukraine is in Russia's Own Interests

World 03:01 PM - 2026-03-02 -

Iraqi Prime Minister Directs Security Forces to Confront Any Threat to Iraq’s Stability

Iraq 03:12 PM - 2026-03-02

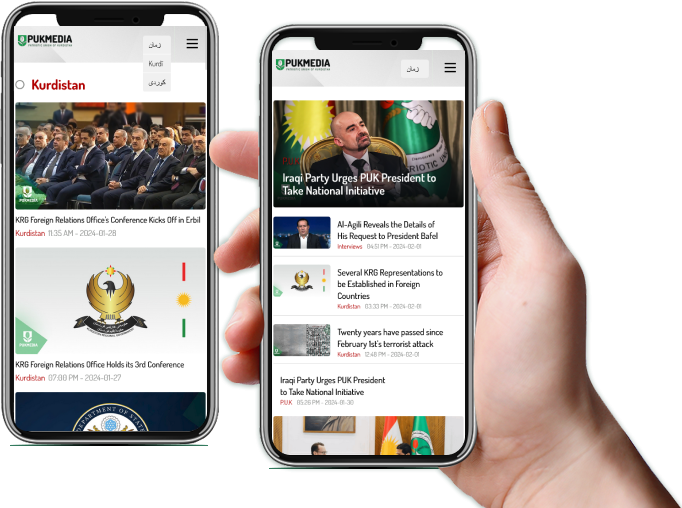

Application

Application