Global Markets React to US Fed Rate Cut: Gold Slips, Dollar Strengthens, Stocks Mixed

Economy 10:20 AM - 2025-09-18.jpg) Freepik

Freepik

Gold and Dollar.

Global markets responded sharply after the United States Federal Reserve cut interest rates by 25 basis points, with gold retreating from record highs, the dollar firming, and stocks delivering mixed performances.

Gold, which had surged to a historic peak of around US$3,707 per ounce, eased to the US$3,650–3,660 range as investors digested the Fed’s cautious stance. A stronger dollar and expectations of slower monetary easing were cited as the main factors weighing on the metal’s appeal.

The dollar strengthened against major currencies following remarks from Fed Chair Jerome Powell, who characterised the rate cut as a “risk-management” step rather than the beginning of an aggressive cycle of easing.

Equity markets showed a varied response. Some indices held close to recent highs, while others recorded modest declines as investors weighed the lack of clear guidance on successive cuts. Powell stressed that decisions would be taken on a “meeting-by-meeting” basis, dampening hopes of a rapid easing cycle.

The stronger dollar has made gold less attractive, while the Fed’s refusal to commit to further reductions has tempered investor optimism. Analysts noted that the resilience of global equities will depend heavily on forthcoming US data, particularly inflation, employment, and consumer spending.

Looking ahead, markets are expected to remain volatile as traders assess incoming economic indicators. Further cuts remain possible, but much will hinge on whether inflationary pressures ease and the labour market remains stable.

Sources: Economic Times, Reuters

PUKMEDIA

More news

-

Oil Rises as US-Israeli Conflict with Iran Expands

09:23 AM - 2026-03-03 -

European Gas Prices Jump 45% as Qatar Stops LNG Production

09:45 PM - 2026-03-02 -

Iraq's PM Orders Investigation into Assassination of Women's Rights Activist in Baghdad

09:38 PM - 2026-03-02 -

Mazloum Abdi Meets Joint Delegation from Qamishli and Damascus

07:42 PM - 2026-03-02

see more

U.S. President Says ‘Big Wave’ is Yet to Come in War with Iran

07:55 PM - 2026-03-02

'This is Not Iraq, This is Not Endless' Says U.S. Secretary on Iran

07:22 PM - 2026-03-02

Iraqi Prime Minister Directs Security Forces to Confront Any Threat to Iraq’s Stability

03:12 PM - 2026-03-02

US Warplanes Crash in Kuwait as Regional Tensions Escalate

11:22 AM - 2026-03-02

Most read

-

Oil Prices Surge as Strikes on Iran Rattle Global Energy Markets

News 09:52 AM - 2026-03-02 -

European Gas Prices Jump 45% as Qatar Stops LNG Production

Economy 09:45 PM - 2026-03-02 -

US Warplanes Crash in Kuwait as Regional Tensions Escalate

World 11:22 AM - 2026-03-02 -

Lebanon Govt Bans Hezbollah's Military Activities As Israel Retaliates After Attacks

World 04:18 PM - 2026-03-02 -

Iraq's PM Orders Investigation into Assassination of Women's Rights Activist in Baghdad

Iraq 09:38 PM - 2026-03-02 -

'This is Not Iraq, This is Not Endless' Says U.S. Secretary on Iran

World 07:22 PM - 2026-03-02 -

Kremlin Says Continuing Talks With Ukraine is in Russia's Own Interests

World 03:01 PM - 2026-03-02 -

Iraqi Prime Minister Directs Security Forces to Confront Any Threat to Iraq’s Stability

Iraq 03:12 PM - 2026-03-02

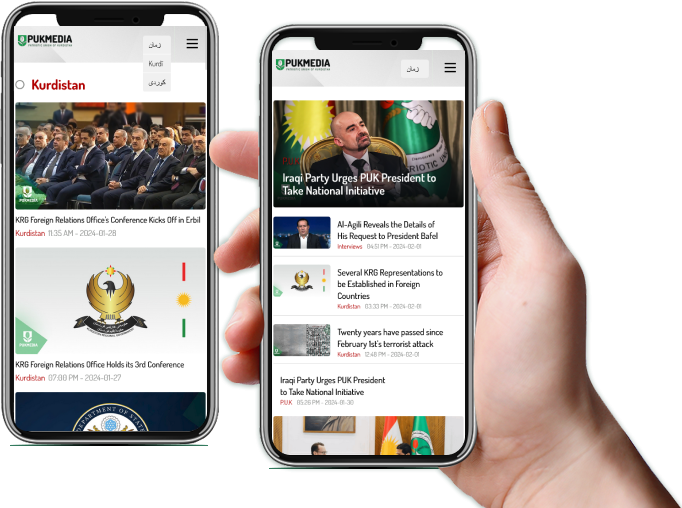

Application

Application