Oil steady as demand concerns offset U.S. crude stock drawdown

Economy 10:06 AM - 2022-07-27

Oil prices held steady on Wednesday as concerns about weaker demand offset industry data that showed a larger-than-expected drawdown in U.S. crude stockpiles.

Brent crude futures were at $104.35 a barrel at 0250 GMT, down 5 cents, or 0.05%. U.S. West Texas Intermediate (WTI) crude rose 9 cents, or 0.1%, to $95.07 a barrel. WTI had climbed nearly $1 earlier in the session.

"A sharper decline in inventories should support oil prices, but the rebound was limited by concerns about potential weak demand, and the White House stated that it will further release strategic reserves," said Leon Li, a Shanghai-based analyst at CMC Markets.

In addition, the prospect the U.S. Federal Reserve will announce an aggressive rate rise later on Wednesday weighed on sentiment and limited the rise in oil prices, he said.

After Tuesday's settlement, industry group the American Petroleum Institute said crude stocks in the United States fell by 4 million barrels last week.

That was four times bigger than the decline expected by analysts in a Reuters poll. [EIA/S]

Gasoline inventories fell by 1.1 million barrels, compared with expectations for a build of 3.5 million barrels, the data showed.

The U.S. government's Energy Information Administration releases its weekly oil report later on Wednesday.

The Biden administration said on Tuesday it will sell an additional 20 million barrels of oil from the country's Strategic Petroleum Reserve as part of a previously announced plan to tap the facility to calm oil prices boosted by Russia's invasion of Ukraine and a recovery in demand following the COVID-19 pandemic.

The administration said in late March it would release a record 1 million barrels of oil per day for six months from the SPR. The United States has already sold 125 million barrels from the reserve with nearly 70 million barrels delivered to purchasers.

Meanwhile, the U.S. Federal Reserve is expected to raise interest rates by 75-basis-points later on Wednesday, underlining concern about the outlook for U.S. demand and the prospect of a stronger dollar, which would make dollar-denominated commodities more expensive for buyers holding other currencies.

PUKmedia / Reuters

More news

-

Iraqi President Sets Date for New Parliament's First Session

03:18 PM - 2025-12-16 -

Qubad Talabani: Congratulations to Zakho and All of Kurdistan

02:17 PM - 2025-12-16 -

Baghdad International Airport Receives First European Flight in 35 Years

02:03 PM - 2025-12-16 -

FIFA Fan Award Goes to Zakho SC Fans

01:04 PM - 2025-12-16

see more

PUK and KDP Meet in Erbil

10:43 AM - 2025-12-16

PUK’s Darbaz Kosrat Calls for Kurdish Unity in Baghdad and Swift Formation of New Cabinet

11:06 PM - 2025-12-15

Qubad Talabani Discusses Flood Response and Development Plans for Garmian

06:50 PM - 2025-12-15

PUKMEDIA Releases Weekly Digital Newsletter – Issue 154

09:18 AM - 2025-12-15

Most read

-

FIFA Fan Award Goes to Zakho SC Fans

Kurdistan 01:04 PM - 2025-12-16 -

Recent Heavy Rains Boost Water Storage Across Kurdistan Region and Iraq

Kurdistan 01:38 PM - 2025-12-15 -

Iraqi Prime Minister Orders Review of Kurdistan’s Non-Oil Revenues

Iraq 07:00 PM - 2025-12-15 -

PUK’s Darbaz Kosrat Calls for Kurdish Unity in Baghdad and Swift Formation of New Cabinet

P.U.K 11:06 PM - 2025-12-15 -

Qubad Talabani Discusses Flood Response and Development Plans for Garmian

Kurdistan 06:50 PM - 2025-12-15 -

PUK and KDP Meet in Erbil

P.U.K 10:43 AM - 2025-12-16 -

Baghdad International Airport Receives First European Flight in 35 Years

Iraq 02:03 PM - 2025-12-16 -

Oil Prices Decline on Russia–Ukraine Peace Hopes and Weak China Data

News 09:12 AM - 2025-12-16

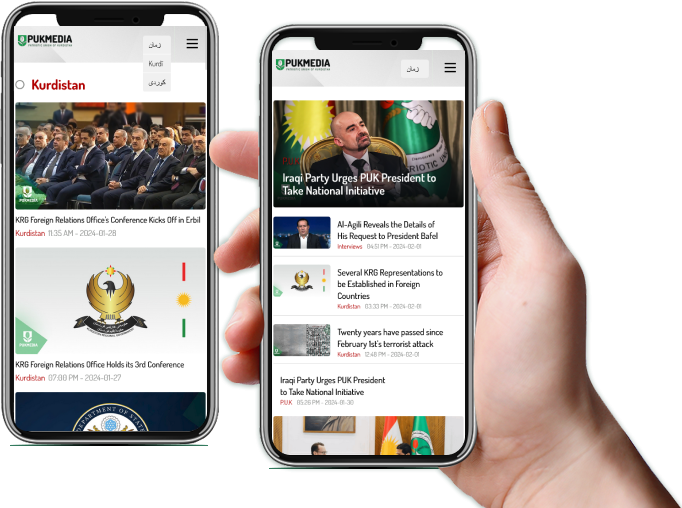

Application

Application